Digital transformation has revolutionized all possible industries, this of course includes banks and financial institutions, who have seen how their tedious processes have gone from manual work to being automated with modern tools, such as UiPath.

But what is UiPath? In Simplilearn, a tech learning platform, they explain “UiPath is a robotic process automation tool for end-to-end automation on a large scale. For accelerated business change, it provides solutions for businesses to automate routine office activities. It uses a variety of methods to transform tedious tasks into automated processes.”

Uses of UiPath in the banking industry

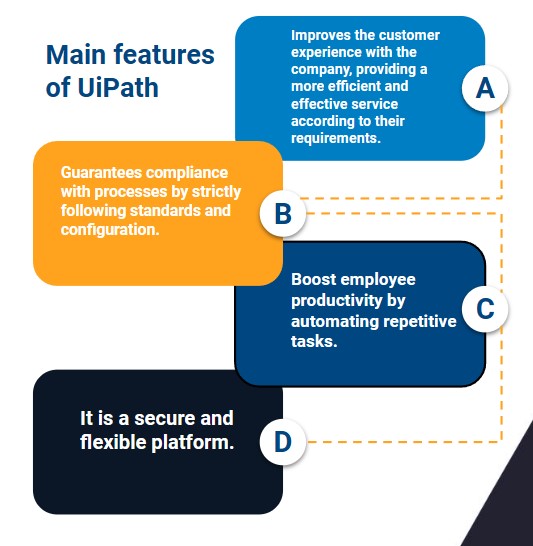

UiPath, a leading robotic process automation (RPA) software provider, offers various solutions for banking institutions. These solutions aim to optimize processes, improve efficiency and improve customer experience.

Some of the key applications of UiPath in banking institutions include:

- Automation of repetitive tasks: it is common to see human staff saturated with repetitive tasks that take away time from dedicating themselves to the client and their needs. UiPath helps automate mundane and repetitive tasks like data entry, report generation, and document processing. This frees up employees' time, allowing them to focus on more complex and strategic tasks.

- Compliance and risk management: Using UiPath helps ensure compliance and risk management by automating the monitoring and reporting of compliance-related processes. This helps banks maintain their regulatory standards and minimize potential risks.

- Fraud Detection and Prevention: Perhaps the greatest danger of any banking institution is an incorrect investment or approving credit to the wrong customer. With UiPath you can analyze large volumes of transaction data in real time, detecting suspicious activities and possible fraud. This helps banks protect their customers and assets from financial losses.

- Improved customer experience: Customers are the priority of any bank. UiPath can automate customer service processes such as answering queries, handling complaints, and managing account updates. This leads to faster response times and greater customer satisfaction.

- Optimizing the administrative process: UiPath can automate various administrative processes such as account opening, loan processing, and payment processing. This results in faster response times, fewer errors and greater operational efficiency.

- Integration of systems and applications: with the rise of Fintech, traditional banking institutions are adapting to new money management trends, creating integration systems with virtual wallets, for example. UiPath can integrate different banking systems and applications, enabling seamless data exchange and streamlined processes across the organization.

By implementing UiPath solutions, banking institutions can improve their overall efficiency, reduce operational costs, and improve customer satisfaction.

UiPath Core Components

Now knowing what this technological tool can do for a banking institution, it is necessary to review the three main components, where the greatest use and benefits are located:

UiPath Studio

Description: UiPath Studio is a graphical development environment that allows users to design, develop and test automation workflows.

Main features:

- Intuitive creation of workflows through a graphical interface.

- Tools for data capture and manipulation.

- Support for various applications and technologies.

UiPath Orchestrator

Description: UiPath Orchestrator is a centralized management platform that facilitates the orchestration, programming and monitoring of software robots.

Main features:

- Scheduling and managing automated workflows.

- Real-time monitoring of robot performance.

- Security and access authorization.

UiPath Robot

Description: UiPath Robot is the component that executes automated tasks in systems and applications.

Main features:

- Reliable execution of automated workflows.

- Integration with business systems.

- Notification of results and exceptions.

With UiPath the improvements are almost endless. At Rootstack we have the ideal team of experts to enhance the processes of your banking institution, accelerating digital transformation and adapting to the demands of today's user.

Contact us and let's start working together, there is no challenge that we cannot meet.

We recommend you on video