One of technology's axioms is that it is ever-changing. Every day, there is a new update to a framework, a widely used software development practice, or a service that all businesses desire. These regular changes are nothing new to the insurtech business.

Insurtech is an abbreviation for insurance technology, and it refers to the application of new technologies and solutions to revolutionize and improve the insurance sector. It includes a wide range of technical improvements, digital tools, and business models aimed at improving different elements of insurance operations, such as product development, underwriting, distribution, claims processing, client experience, and risk management.

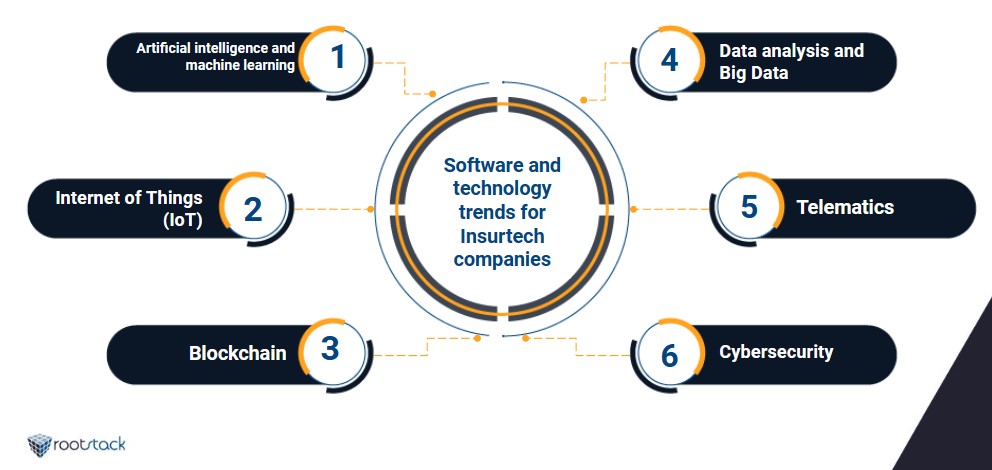

Trends in software and technology for Insurtech firms

In order to deliver the greatest service to their clients, insurtech companies must keep up with technological and software advancements. We have discovered and explained the following current trends:

Machine learning (ML) and artificial intelligence (AI)

AI and machine learning are widely utilized in the insurance industry to automate operations, increase underwriting accuracy, claims management, and personalize consumer experiences. Chatbots and virtual assistants powered by AI are also being used to deliver quick and effective customer service.

IoT (Internet of Things)

Sensors and wearables, for example, create massive volumes of data that can be utilized for risk assessment, loss prevention, and personalized pricing. Insurers are using IoT to provide usage-based insurance, in which premiums are calculated based on real-time data obtained from connected devices.

Blockchain

Insurtech is investigating blockchain technology to improve transparency, security, and efficiency in areas such as policy administration, claims settlement, and fraud prevention. Smart contracts based on blockchain technology can automate claim processes while also ensuring confidence between parties.

Big Data and data analysis

Insurers may acquire more thorough insights into client behavior, risk profiles, and market trends because to the amount of data available in the digital era. Advanced analytics approaches assist insurers in making data-driven decisions, improving underwriting accuracy, and developing customized insurance products.

Telematics

Telematics entails gathering real-time data from automobiles, such as driving behavior, location, and vehicle problems. Insurers are utilizing telematics to provide usage-based auto insurance, in which premiums are decided based on individual driving patterns, so encouraging safer driving practices.

Cybersecurity

Insurtech firms are focused on comprehensive cybersecurity measures to protect sensitive client data and prevent unauthorized access in response to the increased threat of cyber assaults. Artificial intelligence (AI)-powered cybersecurity systems are being implemented to detect and respond to threats in real time.

Associations for ecosystems and insurtech

To establish entire insurtech ecosystems, insurtech businesses are forming alliances and collaborations with traditional insurance carriers, technology companies, and startups. These ecosystems seek to leverage the strengths of multiple participants in order to provide end-to-end integrated insurance solutions.

Digital customer experience

Insurtech companies are prioritizing the development of user-friendly interfaces, mobile applications and online platforms to improve the customer experience. They are leveraging technologies like AI, chatbots, and data analytics to provide personalized recommendations, prompt customer service, and efficient claims handling.

What have been the areas that have benefited the most from insurtech?

After learning about the technology trends for insurtech companies, let's explore a bit about the areas of the insurance industries that have benefited the most from this mix of technologies and services:

- Distribution and Customer Experience: Insurtech has aided in the creation of online platforms, mobile apps, and comparison websites that streamline the insurance purchasing process, enable personalized policy recommendations, and provide quick access to policy information and claims management.

- Underwriting and risk evaluation: To analyze risks more correctly, automate underwriting operations, and improve pricing models, advanced data analytics and artificial intelligence algorithms are deployed. This enables speedier policy issuance and more precise risk assessment.

- Claims Processing: Insurtech solutions streamline claims management by leveraging technology such as artificial intelligence and image recognition to automate claims handling, detect fraud, and accelerate settlement. This can result in speedier payments and increased customer satisfaction.

- Peer-to-peer and on-demand insurance: Insurtech has aided in the development of peer-to-peer insurance models, in which consumers share their risks and coverage requirements. On-demand insurance platforms provide flexible coverage alternatives that may be turned on and off based on the needs of the policyholder.

- Data-driven insights: Insurtech leverages data analytics and IoT devices to collect and analyze vast amounts of data. This information can be used to gain insight into customer behavior, risk patterns, and market trends, enabling insurers to offer tailored products, improve risk management, and improve operational efficiencies.

Undoubtedly, technology in the business world is there to benefit both the client and the workers, proof of this is insurtech and the changes it has promoted in insurers.

We recommend you on video