A constant in any technological solution or tool is changes. Any software or hardware product must adapt to current trends and respond to the needs of a user who becomes more demanding over time. This of course applies to Fintech.

Before getting into the matter, you may be wondering: What is a Fintech? Well, it is a term that is used to refer to any software, mobile application or technology tool that works to automate and improve banking and financial processes, for companies or natural clients.

Applications like Venmo or Cashapp are examples of Fintech that have caught on with the public and have become a fundamental part of their daily financial movements, so the future looks good for this type of software product, but what are the trends that you will have to adapt to?

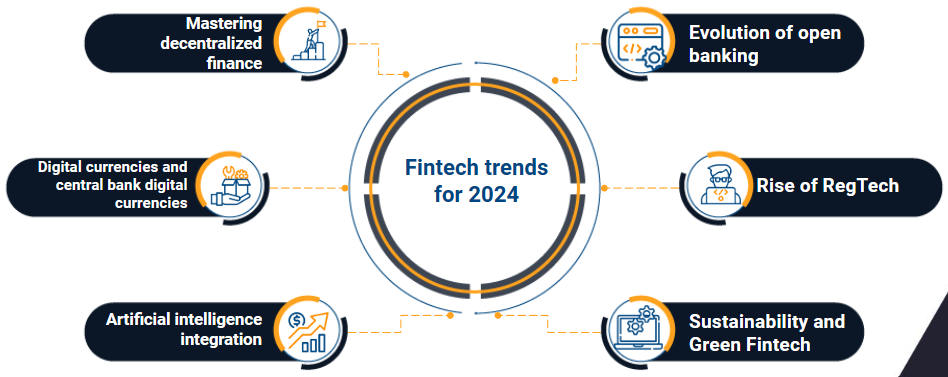

Fintech trends for 2024

As we stand on the cusp of a new era, it is imperative to look into the crystal ball and explore the predictions and trends that will define the future of Fintech.

1. Mastering Decentralized Finance (DeFi)

One of the most notable trends that is gaining momentum is the rise of decentralized finance (DeFi). DeFi platforms leverage blockchain technology to offer traditional financial services, such as loans, borrowing, and transactions, without the need for traditional intermediaries. As the ecosystem matures, we can expect greater adoption, bridging the gap between traditional finance and decentralized solutions.

2. Digital Currencies and Central Bank Digital Currencies (CBDC)

The digital currency revolution is underway, with cryptocurrencies like Bitcoin and Ethereum leading the way. Additionally, central banks around the world are exploring the creation of central bank digital currencies (CBDCs). These digital versions of national currencies could revolutionize payments, settlements and cross-border transactions, offering both efficiency and financial inclusion.

3. Artificial intelligence (AI) integration

Artificial Intelligence continues to be a driver of Fintech innovation. Predictive analytics, personalized financial advice, and fraud detection are just some of the areas where AI is making significant advances. As algorithms become more sophisticated, we can anticipate deeper integration of AI into financial services, improving customer experiences and streamlining operations.

4. Evolution of open banking

Open banking initiatives are reshaping the financial landscape by allowing third-party developers to build applications and services around financial institutions. The future of Fintech will likely see an evolution of Open Banking, with more seamless collaboration between banks and third-party developers, resulting in a broader range of innovative, customer-centric financial products.

5. Rise of RegTech

With the increasing complexity of financial regulations, regulatory technology (RegTech) is on the rise. Fintech companies are leveraging advanced technologies to automate compliance processes, monitor transactions, and ensure compliance with regulatory requirements. This trend is expected to continue as the regulatory environment becomes more complex.

6. Sustainability and Green Fintech

The financial industry increasingly recognizes the importance of sustainability. Green Fintech initiatives are emerging, focused on environmentally friendly financial products and services. From green investments to carbon footprint tracking, fintechs are poised to play a crucial role in aligning financial activities with sustainability goals.

7. Integrated finance

The future of Fintech lies in integration and accessibility. Embedded Finance is a concept where financial services are seamlessly integrated into non-financial platforms and services. From e-commerce websites offering instant loans to ride-sharing apps offering insurance, we can anticipate an expansion of financial services integrated into everyday activities.

8. Enhanced security measures

As Fintech becomes increasingly intertwined with our daily lives, security becomes paramount. The future will see greater focus on biometrics, advanced encryption, and decentralized identity solutions to strengthen the security of financial transactions and user data.

Conclusion: Navigating the Fintech frontier

The future of Fintech is an exciting and dynamic landscape where innovation knows no limits. From decentralized finance to the integration of artificial intelligence, the industry is evolving to meet the ever-changing needs of consumers and businesses alike. As we venture into this Fintech frontier, one thing is certain: the future holds a tapestry of possibilities waiting to be woven by financial technology pioneers.

In the coming years, these predictions and trends will not only reshape financial technologies but will also redefine the way we perceive and engage with the financial world. Buckle up, because the journey into the future of Fintech promises to be nothing short of revolutionary.

We recommend you on video