Photo: Claude AI Info

One of the technological tools or solutions most used by industries and companies are chatbots. On any web page that is currently entered, you will find a small chat window in the lower corner where you can answer any questions you have, that is a chatbot.

At IBM they explain “Chatbot technology is now commonplace and found everywhere, from smart speakers in the home to consumer-facing instances of SMS, WhatsApp and Facebook Messenger and workplace messaging applications like Slack. The latest evolution of AI chatbots, often called “intelligent virtual assistants” or “virtual agents,” can not only understand fluid conversations by using sophisticated language models but even automate relevant tasks. In addition to the well-known consumer-oriented intelligent virtual assistants, such as Apple's Siri and Amazon Alexa, virtual agents are also increasingly used in the business context to help customers and employees.”

Chatbots and their use in online banking

If there is one industry that benefits from chatbots, it is the banking industry. Day after day, millions of users worldwide access the websites of their financial institution to seek answers to a concern or information about a banking process.

With the accelerated growth of remote work and the options to perform daily tasks without leaving home, it is logical that people want to know how to make an international transfer for example or what the limit is on their credit card without having to go to the headquarters. of your bank, this is why a chatbot is the ideal tool.

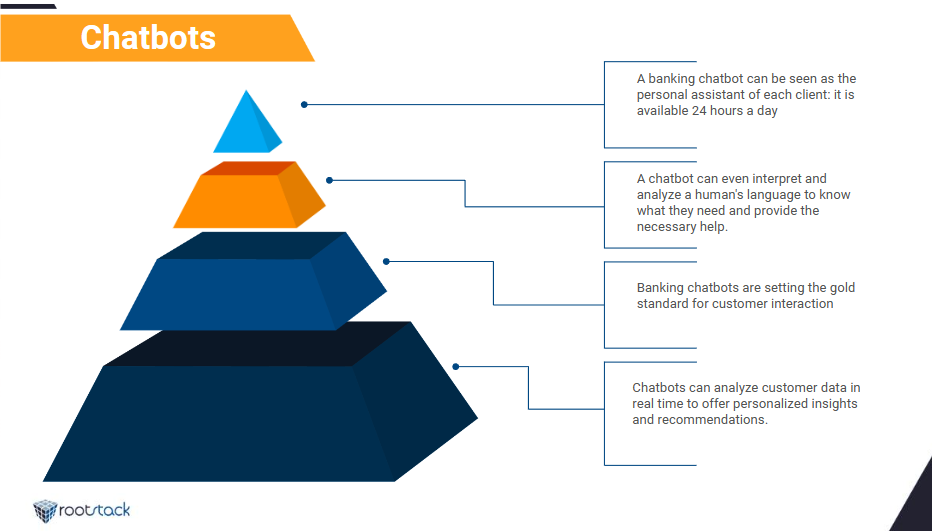

A banking chatbot can be seen as the personal assistant of each client: it is available 24 hours a day, powered with artificial intelligence to provide precise responses and is integrated into the institution's digital platform to be able to help with specific account problems. customer. A chatbot can even interpret and analyze a human's language to know what they need and provide the necessary help.

Do you need to know your account balance, interest rate or transaction history? Just ask. Do you want to transfer funds or schedule an appointment? Consider it done. A properly trained chatbot can provide solutions to these questions and more. Banking chatbots are setting the gold standard for customer interaction, making it faster, smoother and more intuitive than ever.

Evolution of the chatbot in online banking

The evolution of chatbots in banking has been a fascinating journey, marked by technological advances and changing consumer needs.

- Early adoption (2000s): Early adoption of chatbots in banking focused primarily on basic customer service functions. These early bots were rules-based and could handle simple queries, such as checking account balances and transaction history.

- Integration with messaging platforms (2010s): To make chatbots more accessible to users, many banks integrated them with popular messaging platforms such as Facebook Messenger and WhatsApp. This allowed customers to interact with their banks using familiar messaging apps, making banking services more convenient.

- AI-powered virtual assistants (2010s): Some banks introduced AI-powered virtual assistants that could perform a wide range of tasks, including fund transfers, bill payments, and even providing financial advice. These virtual assistants could handle more complex tasks and offer a higher level of service.

- Voice-activated chatbots (2010s): With the rise of voice-activated virtual assistants like Amazon Alexa and Google Assistant, banks began integrating voice technology into their chatbots. This allowed users to perform banking tasks using voice commands, further increasing the accessibility and convenience of these services.

- Advanced Security Features (2020s): As cybersecurity concerns have increased, chatbots in banking have integrated advanced security features such as biometric authentication and multi-factor authentication to ensure sensitive customer information is protected.

- Integration with AI and analytics (2020s): The latest evolution involves deeper integration with artificial intelligence and analytics. Chatbots can analyze customer data in real time to offer personalized insights and recommendations, improving the overall customer experience and providing more value-added services.

At Rootstack we have the team of experts necessary to create a functional chatbot that meets the needs of the company, just contact us and we will start working together.

We recommend you on video