Artificial intelligence is no longer a technology exclusive to the most brilliant technicians or minds in the industry, it has now become something of daily use for millions of people, including the industrial sector, specifically banking institutions.

The ability of artificial intelligence to understand and simulate a company's internal work processes makes it ideal for the banking sector, who need to streamline its mechanisms and flows to give its users quick and effective attention, leaving minimal room for errors.

Of course, there will always be detractors to the use of this technology. As IBM mentions in one of its articles “AI applications grow every day. But as the buzz around the use of AI tools in businesses grows, conversations about AI ethics and accountability become vitally important.”

Technology and the banking industry

Like all companies in the industrial sector, financial institutions have had to adopt new technologies within their workflow and the services they offer to their clients and users. Banks, to mention something, now have mobile and web applications available from where their clients can make the movements they need without having to go to a physical office.

Artificial intelligence is part of the technologies that banks use today. In a study by the law firm Baker McKenzie, they point out “Both AI and machine learning (ML) are increasingly used in a variety of applications, for example, to assess credit quality, set prices and market insurance contracts and automate interactions with customers, commonly with chatbots.”

They go on to say “In addition, fund managers and stockbrokers use them to improve returns and optimize trade execution, while regulators and financial institutions alike use them to assess data quality and conduct surveillance to regulatory compliance and fraud detection.”

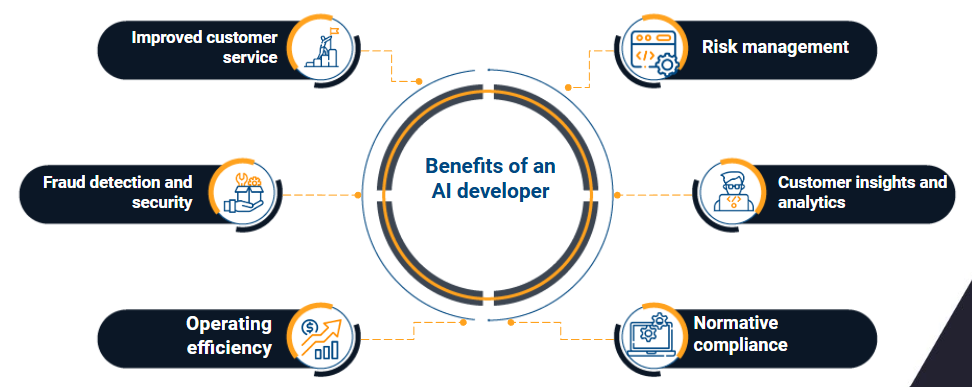

Benefits of an artificial intelligence developer for a banking project

Integrating an AI developer into a banking project can offer numerous benefits. Here are some of the key benefits:

1. Improved customer service

- Chatbots and virtual assistants: AI developers can create chatbots and virtual assistants that provide 24/7 customer support, answer queries, and complete transactions, improving customer satisfaction and reducing operational costs.

- Personalized banking experience: AI can analyze customer data to offer personalized product recommendations, financial advice, and personalized banking solutions.

2. Fraud detection and security

- Real-time fraud detection: AI systems can analyze transaction patterns and detect anomalies in real-time, significantly reducing the risk of fraud.

- Enhanced Security: AI can strengthen security protocols through biometric authentication such as facial recognition and voice recognition, ensuring banking services are secure.

3. Operational efficiency

- Automation of routine tasks: AI can automate routine tasks such as data entry, account management, and loan processing, freeing up human resources for more complex tasks.

- Process Optimization: AI can streamline various banking processes, identify inefficiencies, and suggest improvements, resulting in cost savings and faster service delivery.

4. Risk management

- Predictive analytics: AI can assist in risk assessment by analyzing large data sets to predict market trends, customer behavior, and potential risks.

- Credit scoring: AI algorithms can improve credit scoring models by incorporating a broader range of data points, leading to more accurate and fair credit decisions.

5. Customer information and analysis

- Behavioral analysis: AI can provide insights into customer behavior, preferences, and trends, allowing banks to adapt their services and marketing strategies effectively.

- Sentiment Analysis: AI can analyze customer feedback from various channels to measure customer sentiment and proactively address issues.

6. Regulatory compliance

- RegTech Solutions: AI can assist in regulatory compliance by automating the monitoring and reporting of regulatory requirements, reducing the risk of non-compliance and associated penalties.

- Document processing: AI can automate the processing and verification of documents required for regulatory compliance, speeding up the onboarding process and reducing errors.

7. Innovation and competitive advantage

- New product development: AI can help banks develop innovative products and services, such as robo-advisors for investments, AI-powered financial planning tools, and blockchain-based solutions.

- Market differentiation: By adopting AI technologies, banks can differentiate themselves in a competitive market, attracting tech-savvy customers and improving their market position.

8. Cost reduction

- Reducing human error: Automating processes with AI minimizes the likelihood of human error, resulting in cost savings on corrections and rework.

- Lower operating costs: Improvements in automation and efficiency translate into lower operating costs, improving profitability.

An AI developer can significantly transform a banking project by improving customer service, improving security, streamlining operations, and driving innovation. Strategic implementation of AI technologies can lead to a more efficient, secure, and customer-centric banking experience.

We recommend you on video