Are you having trouble capturing and efficiently following up on potential clients? A CRM is the answer and you can read more about it in this blog.

Imagine an insurance company with dozens of agents constantly on the move, each serving current and prospective clients at various stages of the sales process. Until recently, this company managed its entire operation with spreadsheets, scattered emails, and unrecorded calls.

Mistakes were common: forgotten clients, duplicate tasks, and leads that never got followed up on. But that all changed when they adopted CRM software designed specifically for insurance companies.

In less than six months, the company not only organized its workflow, but increased its conversions by 35%. Agents now prioritize higher-potential leads and have real-time data—all from their mobile devices.

What enabled this change? A CRM with key features that transformed the way they operate.

Below, we’ll explore the essential features a CRM for the insurance industry should have, the problems it solves, and how custom insurance software solutions can make a difference.

Must-Have CRM features for insurance companies

1. Workflow organization: Streamlining from the start

An effective CRM centralizes all customer interactions, such as emails, calls, and policy requests. Not only does this improve organization, it eliminates the need for separate tools. For an insurance company, this means:

- Consolidating customer histories.

- Quick access to policy and claim details.

- Automating repetitive tasks, such as reminders for renewals.

With this organization, agents can focus on strategic tasks and reduce operational errors.

Problem it solves:

Disorganization and loss of key data, which previously resulted in customer dissatisfaction and lost opportunities.

2. Efficient lead capture and follow-up

In the insurance industry, leads come from multiple channels: social media, website forms, phone calls, or referrals. A modern CRM automatically captures this data in a single dashboard, ensuring no opportunity is missed. It also allows for structured follow-up that keeps prospects engaged.

Problem it solves:

The lack of a centralized system to manage leads, which led to confusion and delays in initial contact.

3. Automatic lead distribution

Assigning leads to the right agent can be a challenge when done manually. An advanced CRM automates this task based on criteria such as:

- Type of policy requested.

- Geographic location.

- Agent availability.

This approach not only improves the customer experience by assigning a specialized agent, but also increases conversion rates by reducing wait times.

Problem it solves:

Inefficient processes that delayed contact with prospects, affecting the perception of service.

4. Prioritizing high-value prospects

Not all prospects have the same level of interest or profitability for the company. An effective CRM allows you to categorize and prioritize prospects based on:

- Financial capacity.

- Source of the prospect (referrals, marketing campaigns).

- Probability of conversion based on previous interactions.

This ensures that agents focus their efforts on the most valuable opportunities, maximizing results.

Problem it solves:

The lack of a clear strategy to prioritize prospects, which resulted in wasted resources and low efficiency.

5. Mobile Compatibility

In a dynamic industry like insurance, where agents are often on the move, mobile compatibility is essential. A mobile-friendly CRM allows:

- Access to data in real time.

- Updating information from anywhere.

- Immediate response to queries or requests.

In addition, this feature improves the customer experience, as agents can interact more quickly and efficiently.

Problem it solves:

The dependence on desktop tools that limited the response capacity of agents in the field.

6. Analytics and Reporting

A CRM for insurance should offer advanced analytics and reporting tools that allow you to:

- Monitor agent performance.

- Identify trends in policy applications.

- Prevent churn through predictive analytics.

These capabilities not only facilitate data-driven decision making, but also help companies quickly adapt to market demands.

Problem it solves:

Lack of visibility into business performance and market trends, which made strategic decision making difficult.

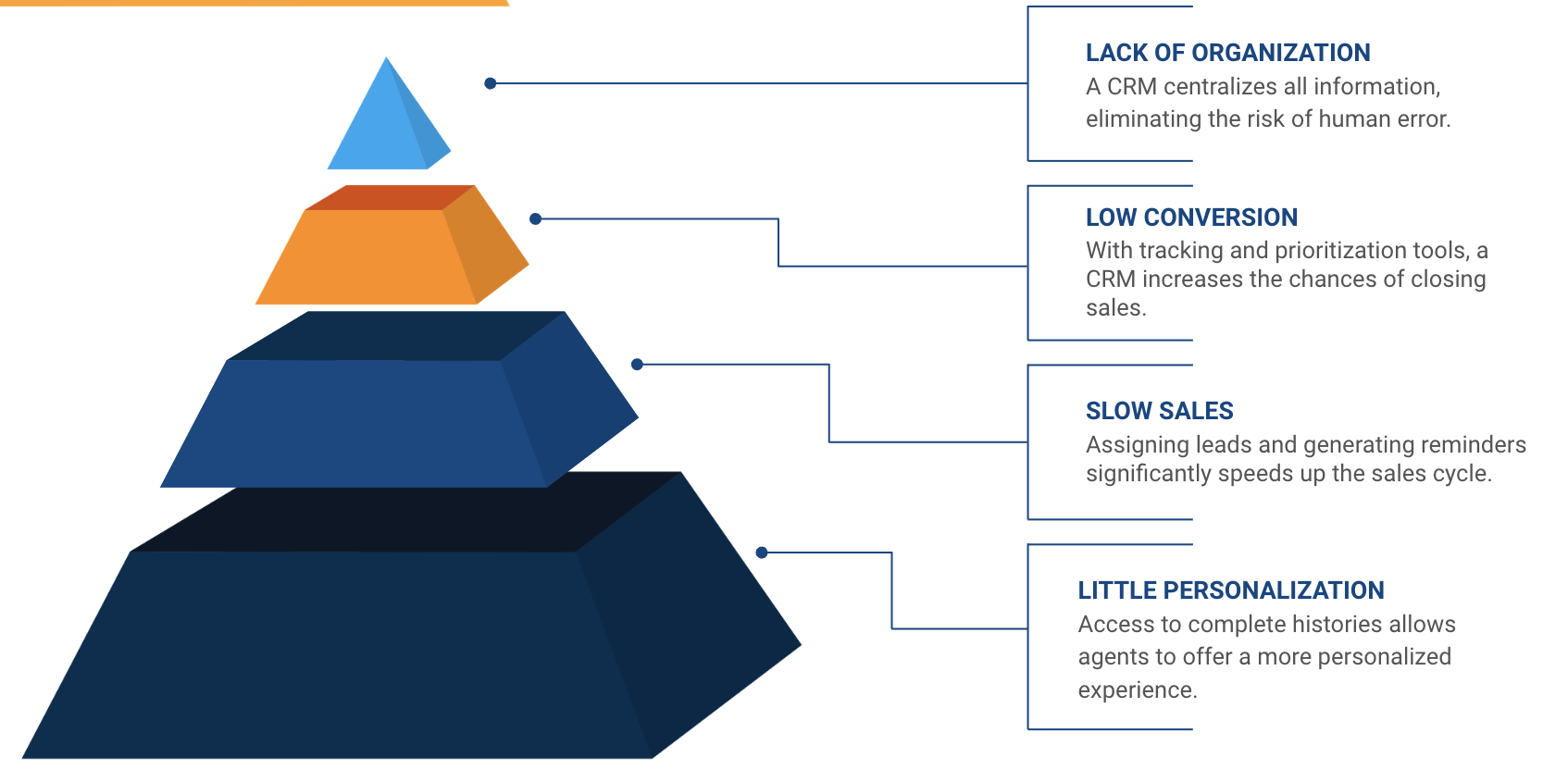

Key Problems a CRM Solves for Insurance Companies

1. Lack of Organization and Data Loss

A CRM centralizes all information, eliminating the risk of human error and ensuring that data is always accessible and up to date.

2. Low Prospect Conversion Rate

With tracking and prioritization tools, a CRM increases the chances of closing sales by ensuring that each prospect receives the proper attention.

3. Slow Sales Processes

Automating tasks such as assigning prospects and generating reminders significantly speeds up the sales cycle.

4. Lack of Personalization in Customer Service

Access to complete histories allows agents to offer a more personalized experience, improving customer satisfaction and loyalty.

5. Difficulty in making data-driven decisions

Detailed reporting and predictive analysis provide managers with key information to make strategic decisions.

How to Choose the Right Solution for Your Insurance Company

Working with a specialized insurance software agency is essential to finding a CRM that fits your company's unique needs. These agencies not only understand the particularities of the insurance industry, but also offer customized solutions with unique features such as:

- Integration with existing systems.

- Artificial intelligence capabilities to predict behaviors.

- Multilingual functionalities for companies with international reach.

The initial example demonstrates how insurance software can completely transform a company's operations. By implementing a CRM designed specifically for the insurance industry, companies can solve critical problems, improve their efficiency, and provide a superior experience to their customers.

If you're looking for a tool that makes a difference, working with a reliable insurance software company can be the first step towards sustainable growth. Invest in a solution that not only addresses your current needs, but prepares your company for the future.